The Future looks cloudy

Significant changes are happening in Canada and Ontario over the next few months. We are currently without a Prime Minister, and Ford has just called for a Provincial election. The potential for new leadership leaves us without a clear direction or a plan for economic policies, taxes, and development. At least towards the end of Trudeau's administration, changes were made to slow immigration and increase demand from first-time home buyers. He adopted the policy "take on more debt, for longer" by increasing insured mortgages and extending amortizations. The goal is to soften the blow of the wave of mortgage renewals and preconstruction completions coming in 2025 and 2026. But what is the plan now? Only time will tell, as federal and provincial candidates will make many 'promises' to fix the previous administration's mistakes.

How does it impact Toronto real estate?

Rents are falling!

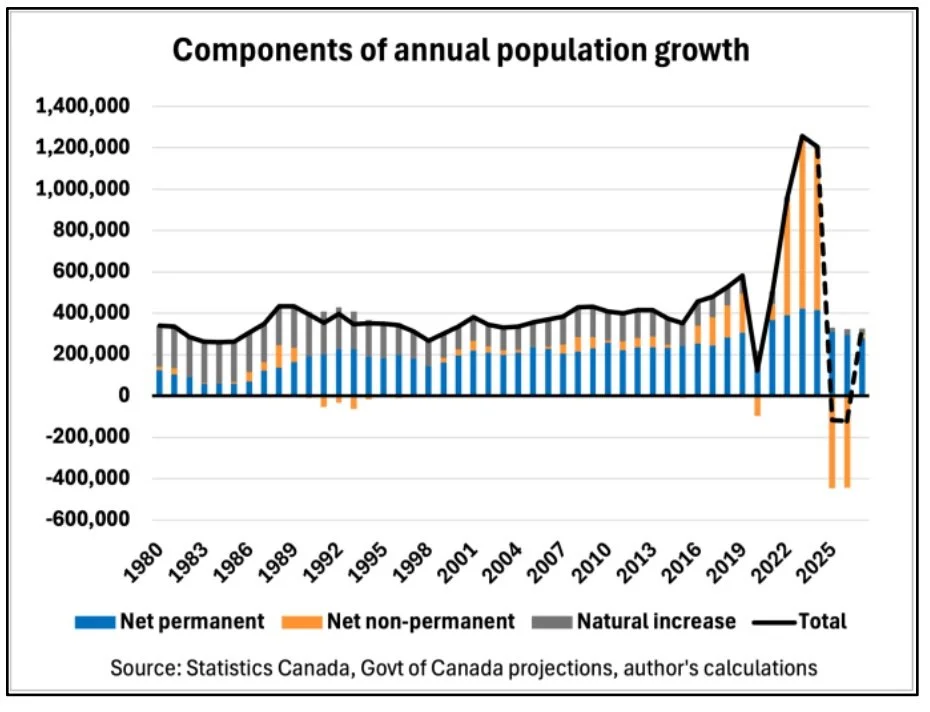

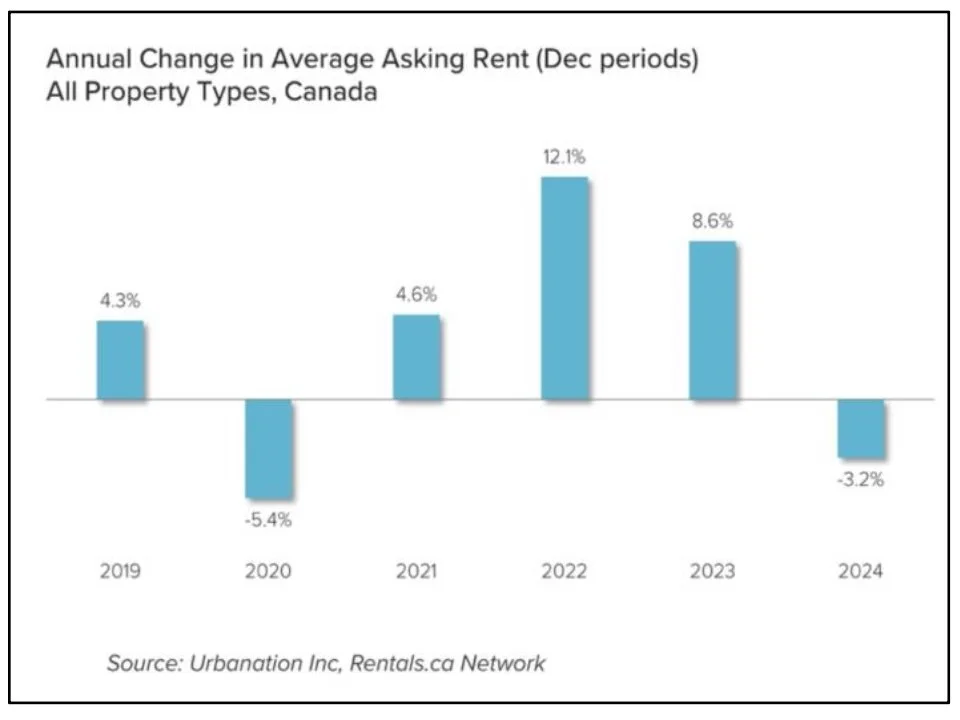

Even before the Federal Government implemented immigration caps, non-permanent population growth declined, naturally caused by weaker employment opportunities and the cost of living. The reduction is happening in the most prominent rental demographic. Some projections suggest that non-permanent residences will be a net negative, with more outflow than inflow, leading to an overall decrease in population.

Whatever it is, the way you tell your story online can make all the difference.

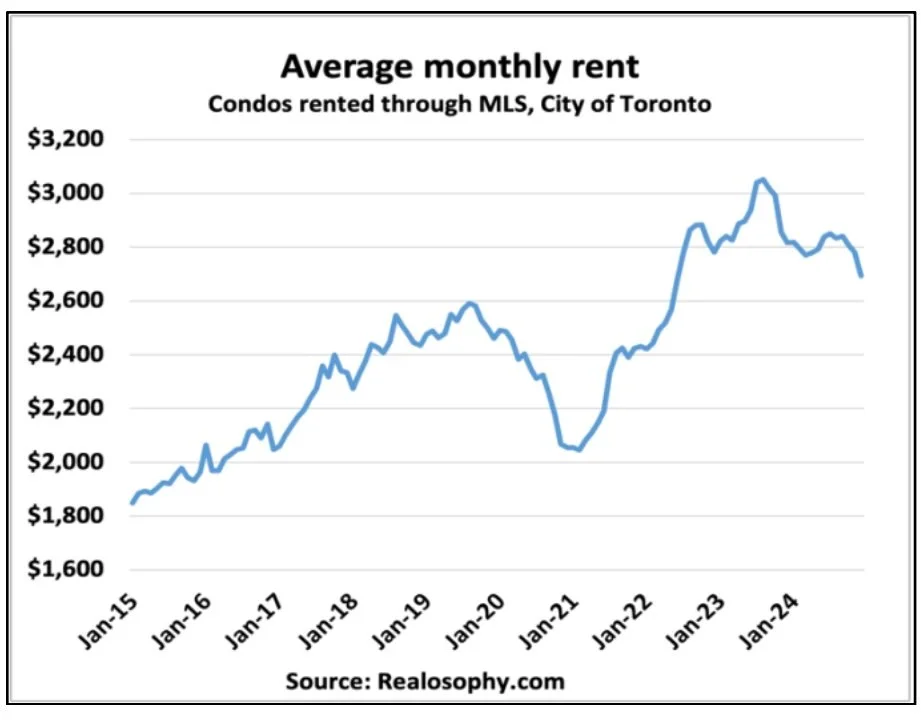

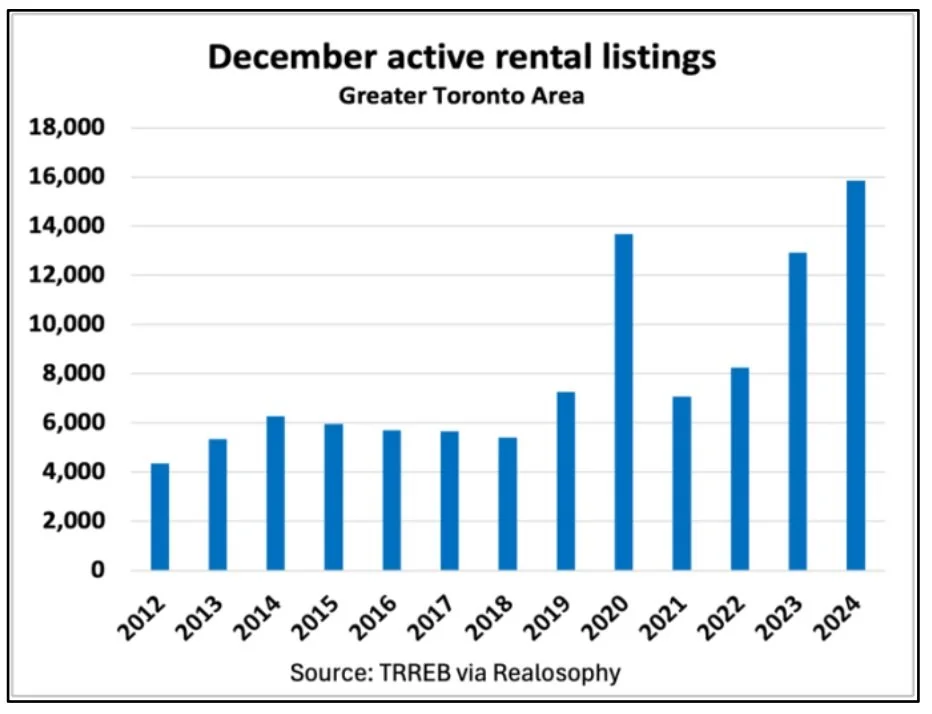

We are already experiencing declining renters and falling rent prices.

Whatever it is, the way you tell your story online can make all the difference.

Whatever it is, the way you tell your story online can make all the difference.

Whatever it is, the way you tell your story online can make all the difference.

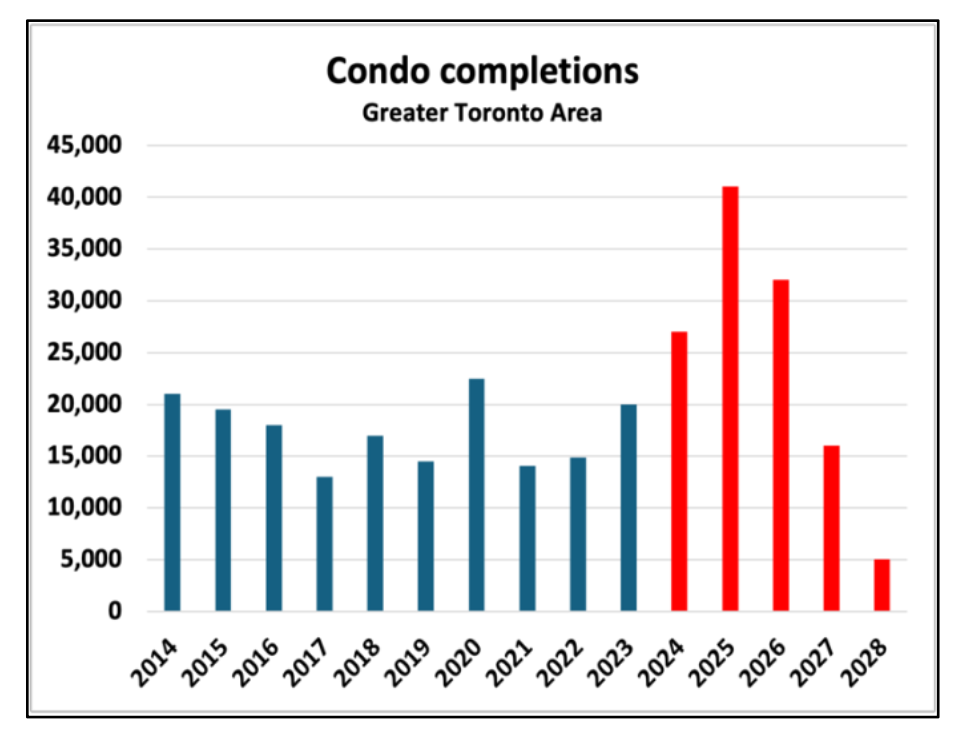

This will likely be compounded by the rising levels of purpose-built rental and preconstruction condos hitting the market.

Whatever it is, the way you tell your story online can make all the difference.

Whatever it is, the way you tell your story online can make all the difference.

Lower demand and higher supply mean one thing - lower prices.

The mortgage renewal wall is coming ...

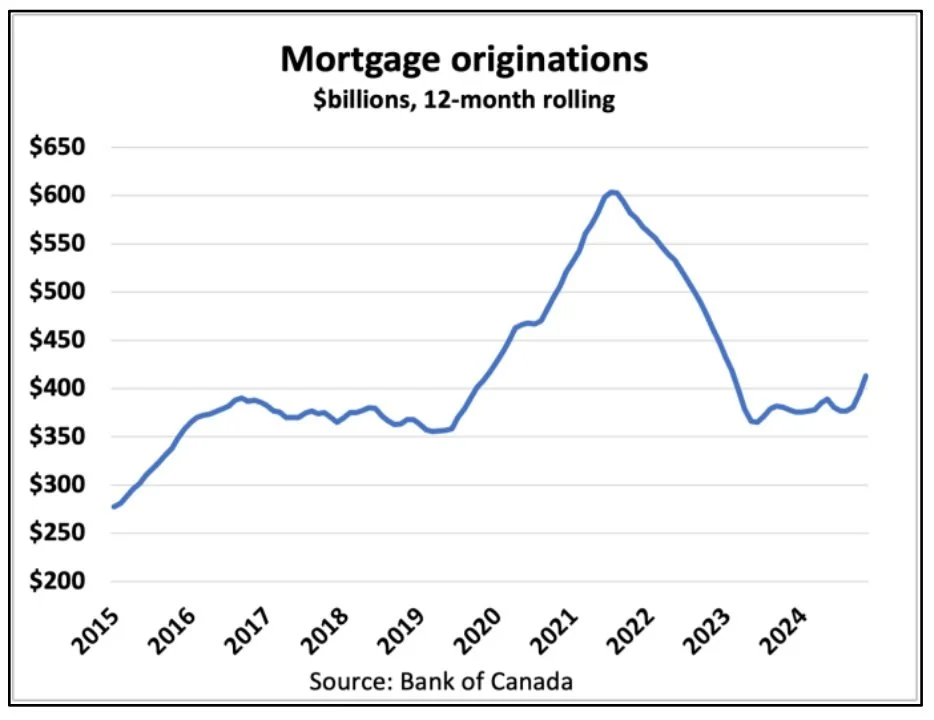

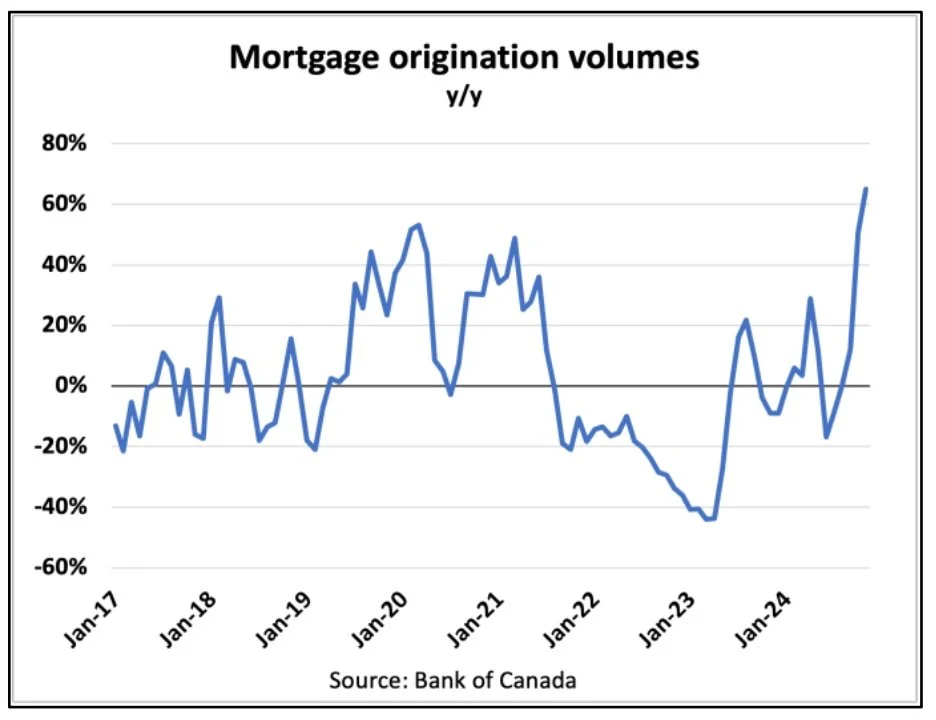

Roughly 60% of Canadian mortgages are renewing in 2025 and 2026. We are starting to see an increase in mortgage originations. Mortgage originations, in dollar volume, began to rise in 2020 and peaked through 2021. Considering that most Canadians opt for 5-year mortgages, we will see the successive wave coming and peaking in 2026.

Whatever it is, the way you tell your story online can make all the difference.

Whatever it is, the way you tell your story online can make all the difference.

During the initial mortgage boom of 2020/21, 5-year interest rates were at all-time lows, around 1%. I remember when the first-ever 0.99% 5-year fixed mortgage was offered for insured mortgages at the end of 2020.

Whatever it is, the way you tell your story online can make all the difference.

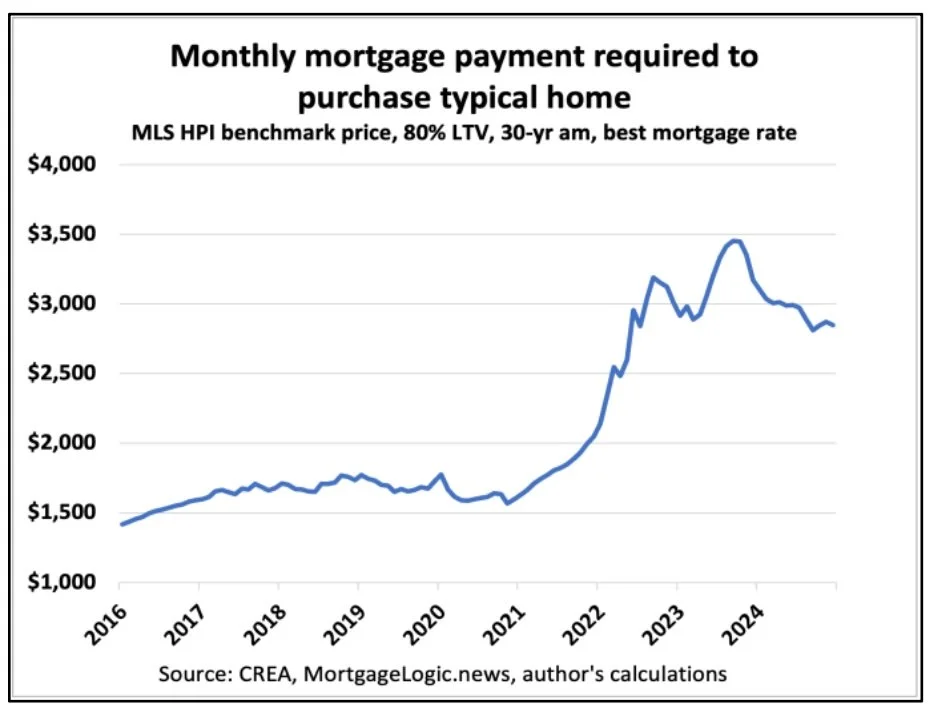

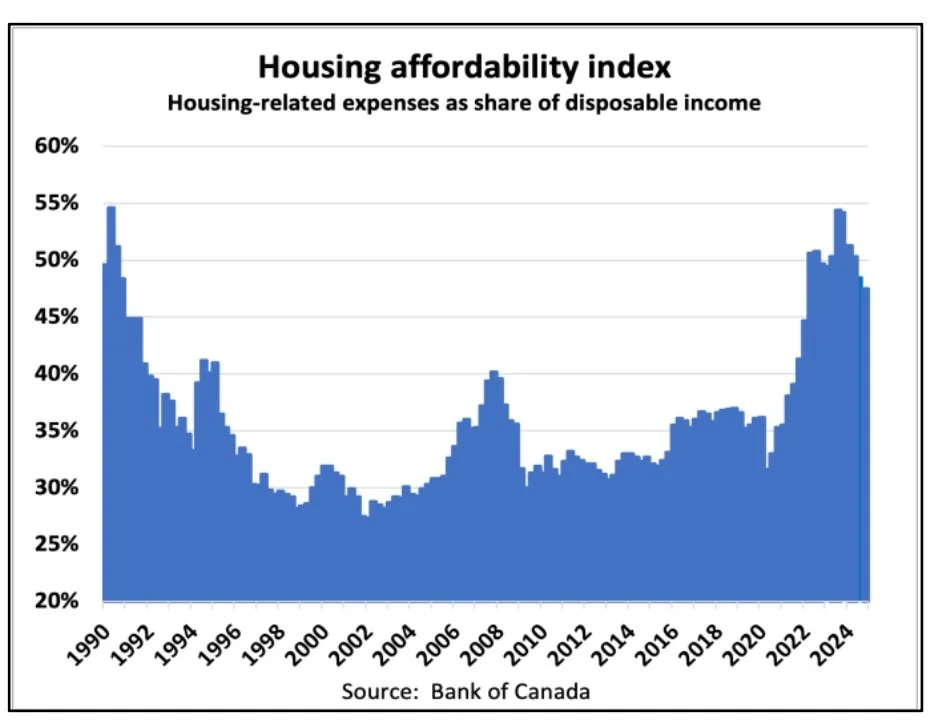

Borrowers will be renewing into a new rate enviroment. Home affordability is still lousy but improving. Monthly mortgage payments have come down since 2022 but are still well above the last decade. The share of disposable income needed to service housing-related expenses on a new purchase is well off the 2023 highs but still at levels last seen in 1991.

Whatever it is, the way you tell your story online can make all the difference.

Whatever it is, the way you tell your story online can make all the difference.

BOC's next move?

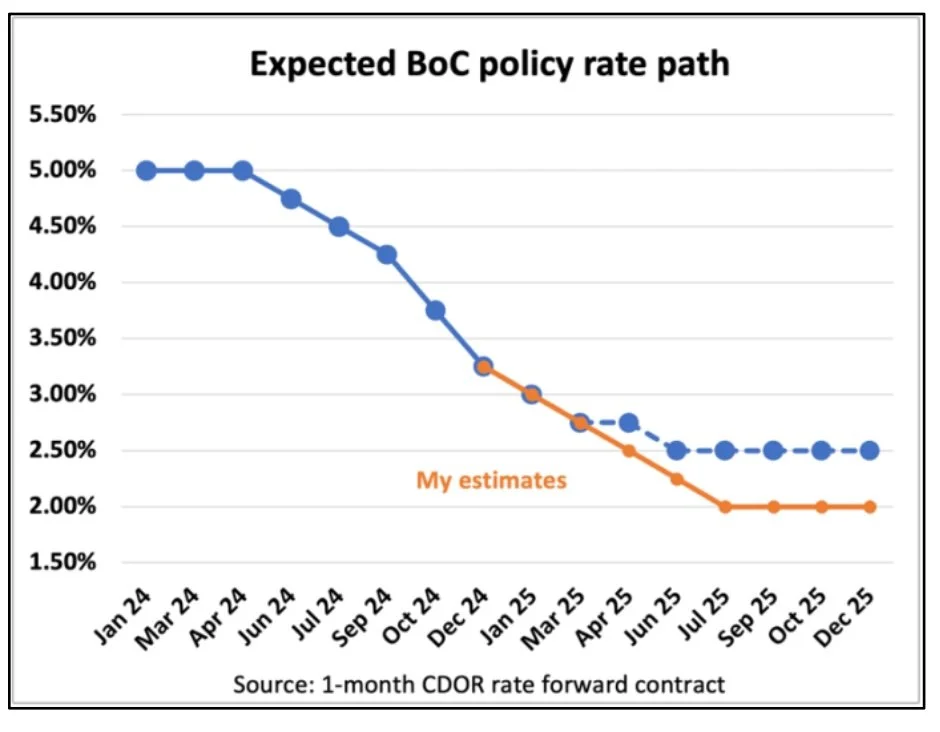

The BOC has been cutting aggressively over the last six months. However, the future trajectory is not so clear-cut. Economists and financial analysts are split on the amount and number of rate cuts to come. Trump's rhetoric of tariffs has spooked the markets with fears of a tariff war and, in turn, re-igniting inflation, causing many to believe the BOC will have to halt any further interest rate cuts. However, with the slowing economy and high Canadian debt levels, the BOC will likely be forced to continue cutting rates.

Feel free to reach out for more information or stay tuned!

Cari and Paul