The BOC has some tough decisions ahead of it, and what it chooses will have significant implications for the real estate market.

The BOC's mandate is to regulate inflation in Canada, but it also plays a role in managing the health of the economy. The Bank has two key levers to 'pull on' to help manage inflation and support the economy; it can either adjust interest rates or alter the money flow. Unfortunately, both options have opposing impacts on inflation and economic growth. Raising interest rates slows inflation but also stymies growth, and conversely, lowering interest rates stimulates growth but permits higher inflation. The same relationship exists with money circulation by the BOC through managing the flow of liquidity in the financial system. What can the BOC do then when the economy is weakening at the same time inflation is rising? A situation that is quickly becoming a reality in Canada.

Weakening Canadian Economy

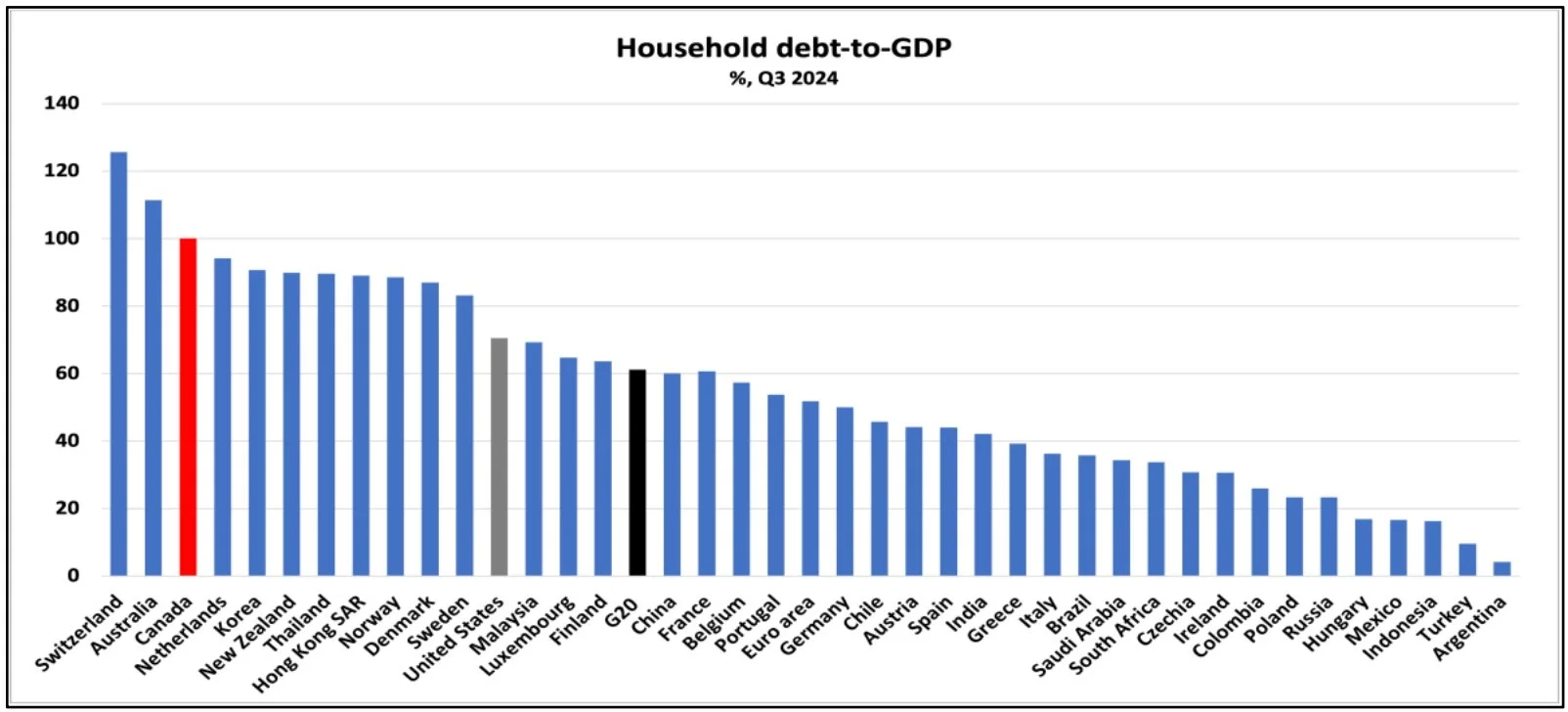

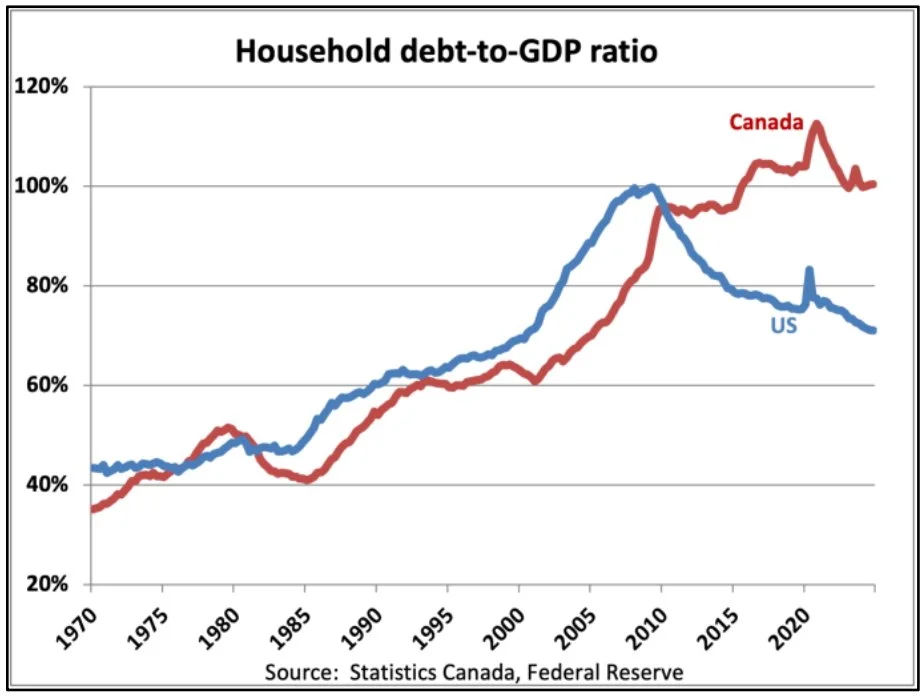

The US trade war is threatening an already delicate Canadian economy. Our economy was already showing signs of cracking under the immense level of debt by Canadian households and businesses with one of the highest Household Debt-to-GDP ratios and Non-Financial Sector Debt-to-GDP ratios in the world.

Whatever it is, the way you tell your story online can make all the difference.

Whatever it is, the way you tell your story online can make all the difference.

Whatever it is, the way you tell your story online can make all the difference.

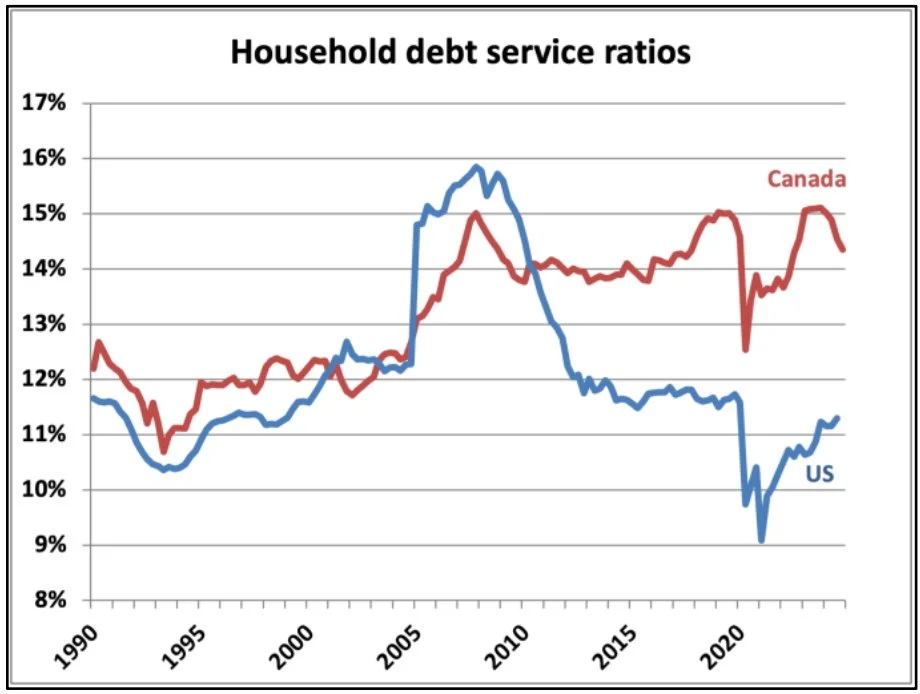

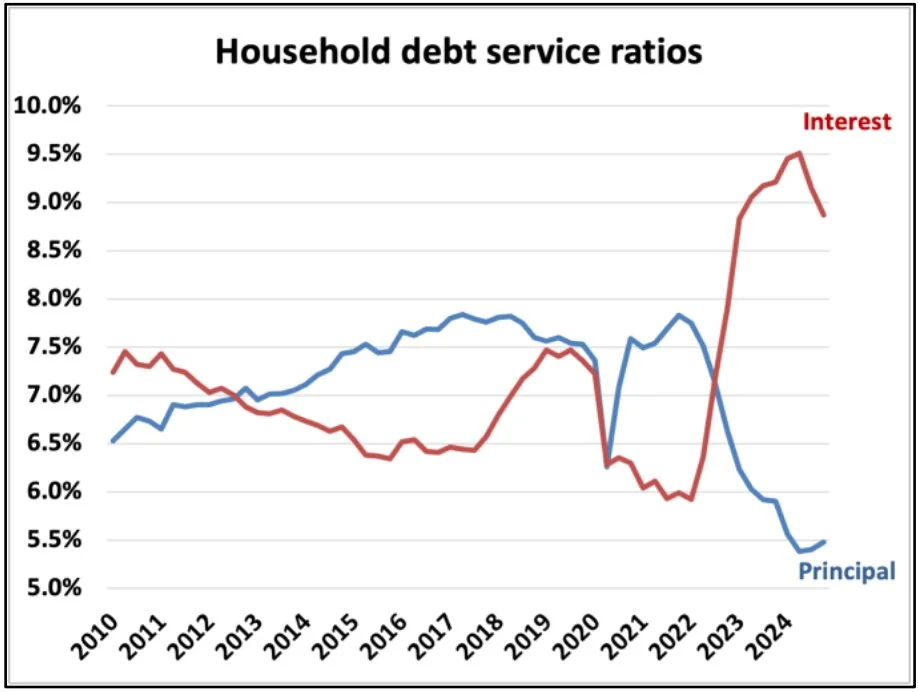

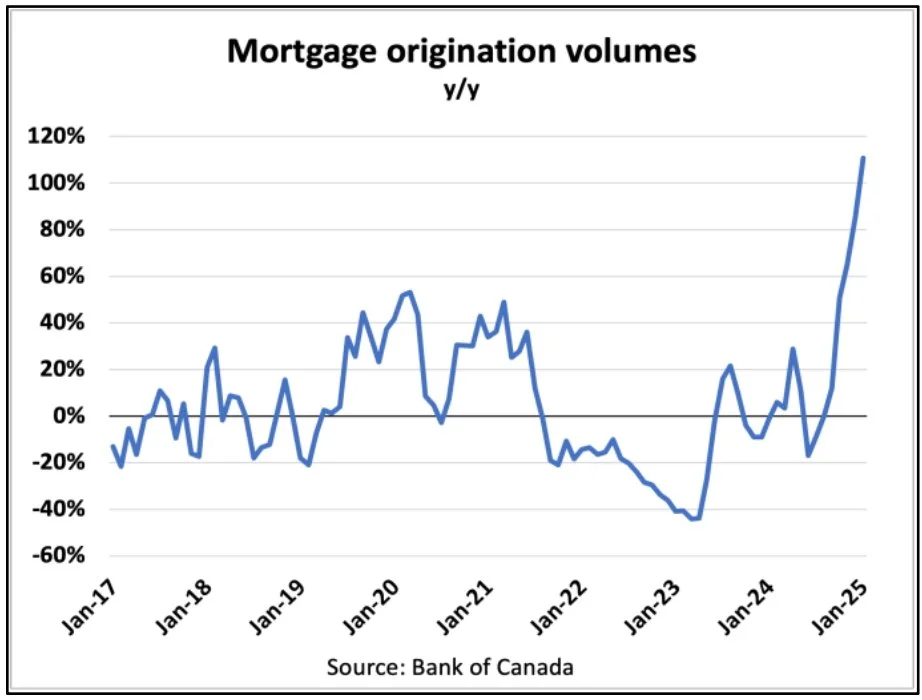

The BOC has been aggressively cutting interest rates to address the amount of financial stress and resources being allocated to service these debts. On the consumer level, every dollar spent on debt is a dollar not spent in the economy. Compared to our southern counterparts, Canadians' debt service ratio is 3% higher, with the lowest level of principal payments in fifteen years.

Whatever it is, the way you tell your story online can make all the difference.

Whatever it is, the way you tell your story online can make all the difference.

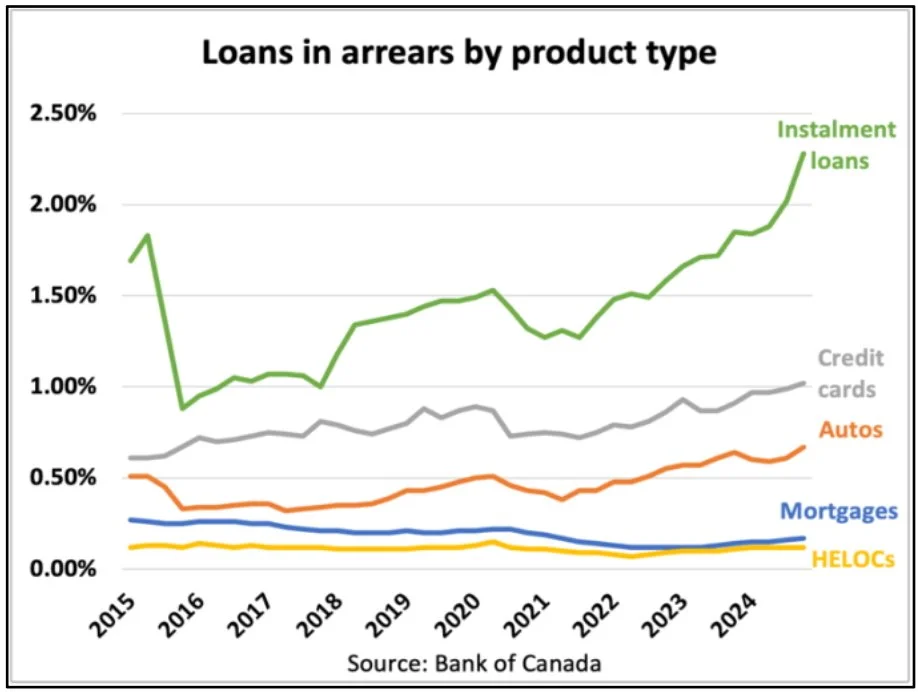

Other lagging metrics, such as Mortgage Delinquencies and Loan Delinquencies, are also rising.

Whatever it is, the way you tell your story online can make all the difference.

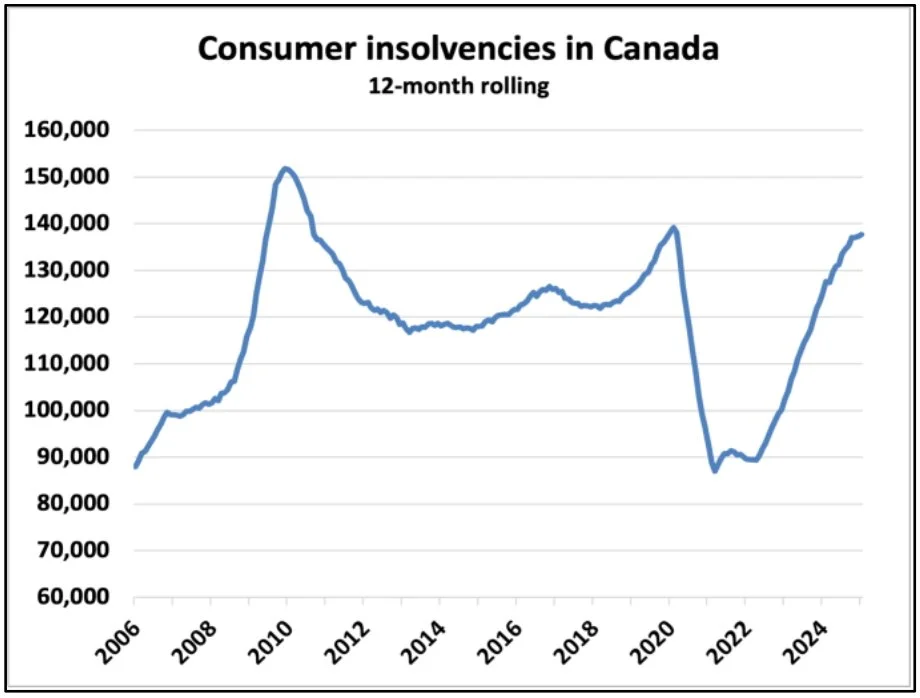

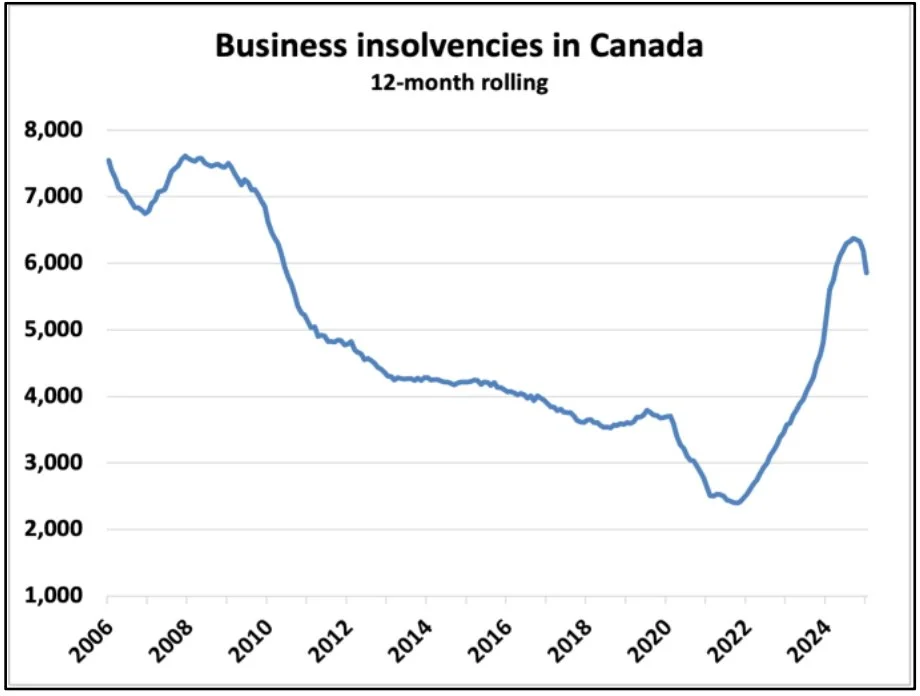

Consumer and business insolvencies are still elevated.

Whatever it is, the way you tell your story online can make all the difference.

Whatever it is, the way you tell your story online can make all the difference.

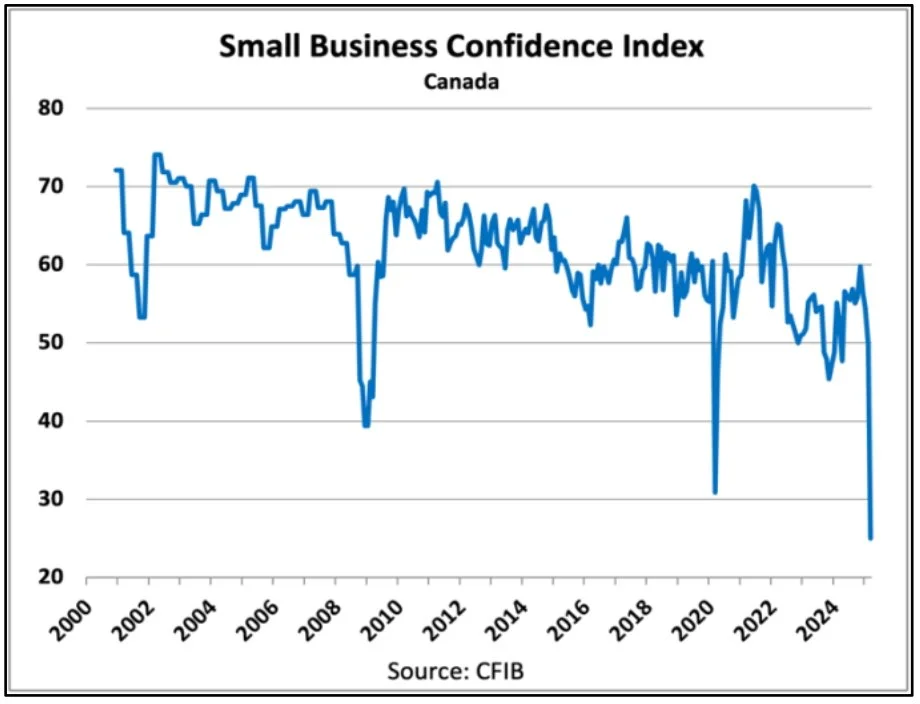

Mix in fear of the threat of tariffs and their potential impacts, and Canadians and Canadian businesses are shocked into a fight, flight, or freeze response. Canadians have banded together to 'fight' the US with counter-tariffs and ban US goods and services. Consumers and businesses are 'freezing' spending to increase savings and buffer against slower times. Although Canada and the US are far from finished the tariff negotiations, the impacts are being felt. We see this in the latest Consumer Confidence and Small Business Confidence report, as both are at all-time lows.

Whatever it is, the way you tell your story online can make all the difference.

Whatever it is, the way you tell your story online can make all the difference.

This will undoubtedly impact the Bank of Canada's decision at their next meeting on April 16th. The BOC is in a bind with deteriorating economic conditions and rising inflation.

Inflation on the rise

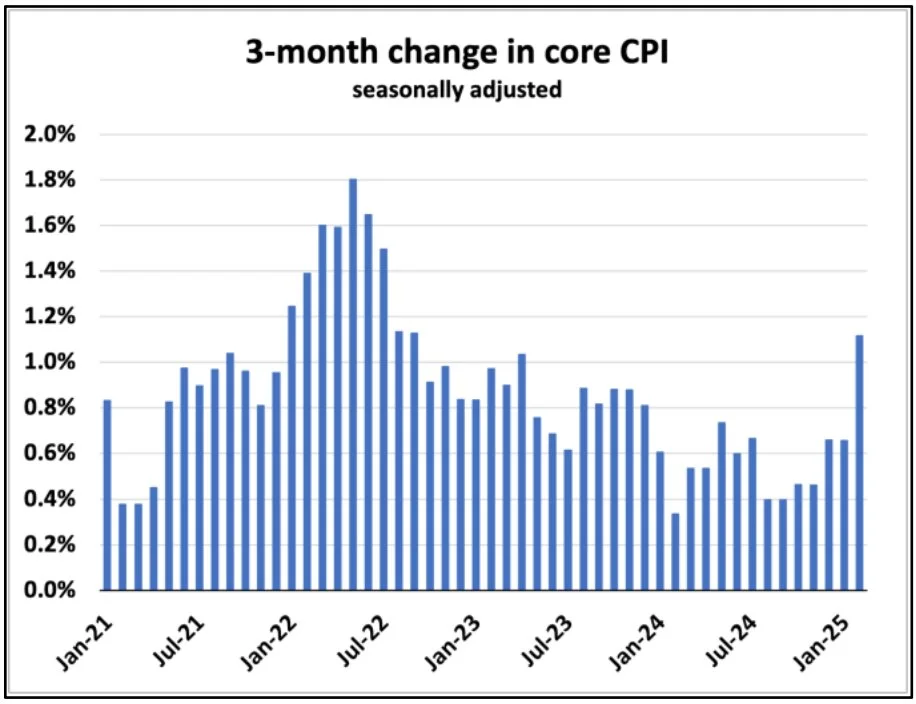

February's inflation numbers came in hotter than expected at 2.6%, a whole 0.4% above expectations. Even the Bank's three preferred measures of Inflation (including Core Inflation) are averaging 2.8%. The three-month change in Core CPI is now pushing 1.2%. The last time the three-month change hit this number, the Bank was preparing to shock the market with a surprise 100 bps increase.

Whatever it is, the way you tell your story online can make all the difference.

Whatever it is, the way you tell your story online can make all the difference.

To complicate matters, the measures that typically correlate with inflation expectations have all tilted higher. The Canadian Federation of Independent Businesses (CFIB) monthly barometer for March found that nearly half of its members expect to raise prices by more than 5% over the next year. That pushed average price expectations up to 3.7% from 3.0% previously. This series has one of the cleanest correlations with the Bank of Canada's measures of core inflation 4 months out.

Whatever it is, the way you tell your story online can make all the difference.

Whatever it is, the way you tell your story online can make all the difference.

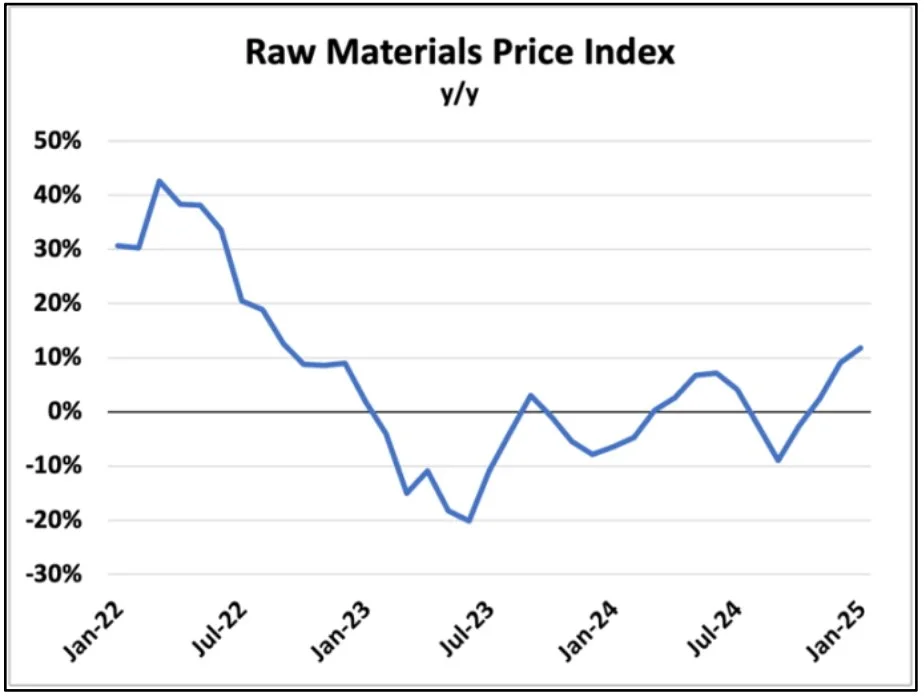

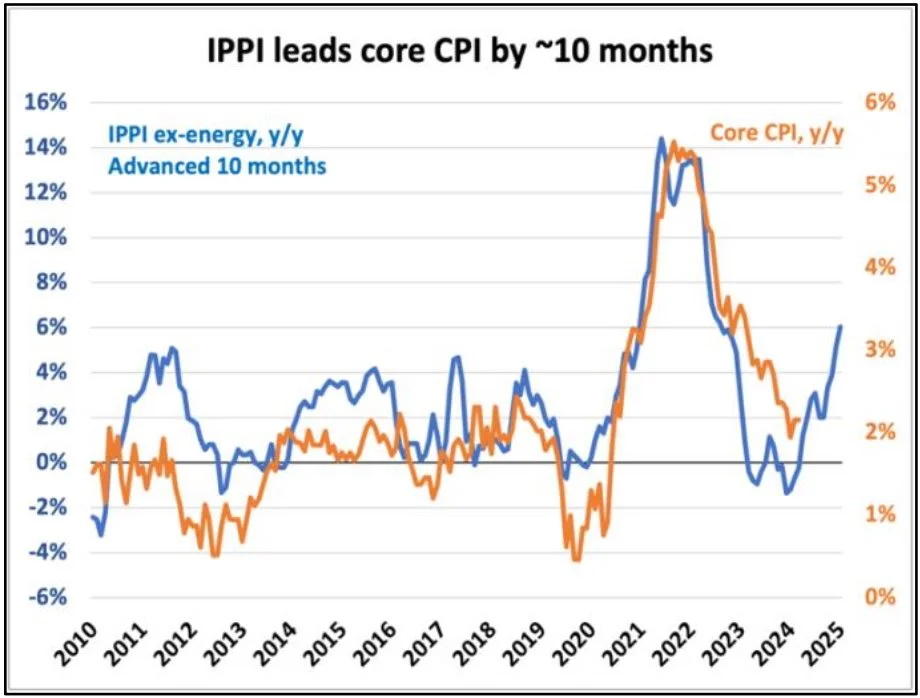

In addition, the inflation reports on Raw Material Costs are up 3.7%, and the Industrial Product Price Index is up 1.6%. These are often precursors to the direction of core inflation 10 months out.

Whatever it is, the way you tell your story online can make all the difference.

Whatever it is, the way you tell your story online can make all the difference.

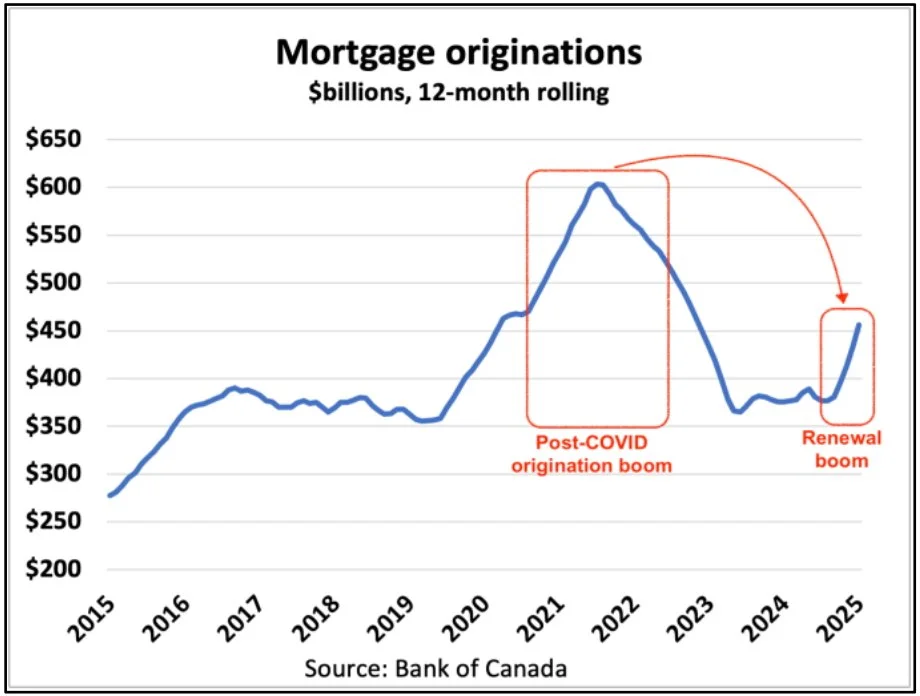

All signs point to inflation troubles ahead. The Bank of Canada will be torn about where to stop the bleeding. And as mentioned, the Bank's tools can not help one area without accelerating and worsening conditions in the other. The BOC likely has some leeway to decrease rates by another 25 bps or 50 bps in the second quarter, but by the second half of the year, it will need to focus on inflation. This means interest rates will stay higher than what many are hoping for or even what many can tolerate. There is still some pain in the system left to be felt; we are looking at about a ~35% monthly payment increase for borrowers who locked in at the lows and are renewing today, and we still have roughly 60% of mortgages set to renew in the next 20 months.

Whatever it is, the way you tell your story online can make all the difference.

Whatever it is, the way you tell your story online can make all the difference.

Whatever it is, the way you tell your story online can make all the difference.

For more insights and information, stay tuned,

Cari and Paul